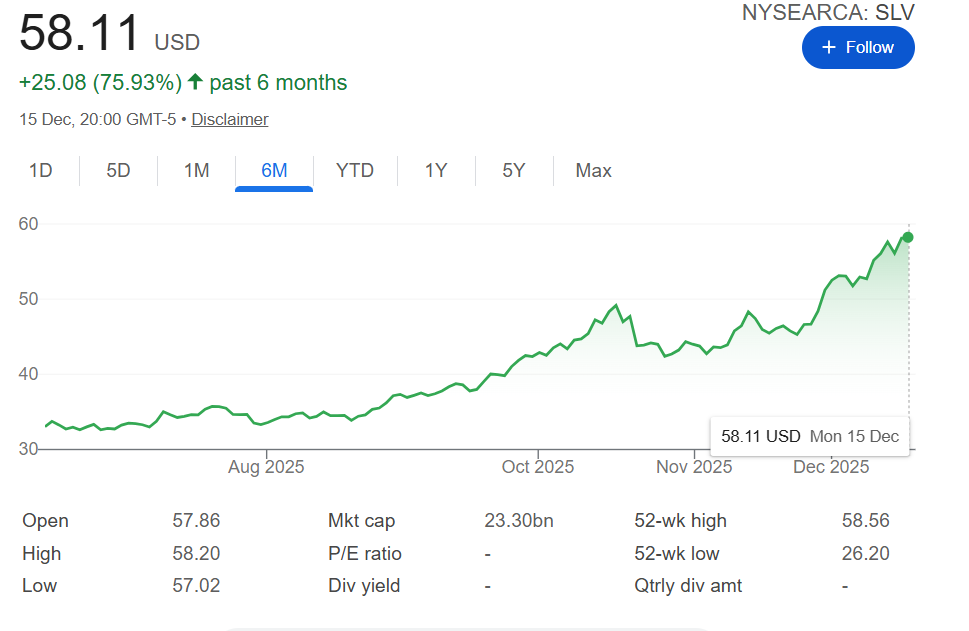

The price of silver has recently surged to an all-time high, reaching $64.66 per ounce on December 12, 2025, as increasing demand and falling stockpiles drive the metal’s value upwards. This sharp price increase has led to a rise of nearly 113% in 2025 alone, prompting many to look for ways to capitalize on the silver rally.

Brokers from SkylineSFO dive into why silver is soaring and how investors can best take advantage of this momentum with the iShares Silver Trust ETF.

Silver’s Explosive Growth

Silver’s growth has been driven by booming industrial demand and supply constraints, with prices reaching all-time highs by mid-December 2025. A key factor is the drop in China’s silver stockpiles, which have hit 10-year lows, pushing prices higher. Silver is increasingly used in electric vehicles (EVs), electronics, solar panels, and aircraft components, bolstering industrial demand.

Additionally, silver is considered a safe-haven asset, attracting investors seeking to hedge against inflation and economic uncertainties. The U.S. Federal Reserve’s recent interest rate cuts have further boosted silver’s appeal as a valuable portfolio asset.

The Role of Government Policies in Silver’s Price Surge

In addition to strong industrial demand and investor appetite, government policies have boosted silver’s growth. In November 2025, the U.S. President added silver to the list of critical minerals, highlighting its importance to the U.S. economy and national security. This move has prompted efforts to strengthen domestic supply chains for silver, reducing reliance on imports.

The Silver Institute projects that silver demand will continue to rise, particularly as artificial intelligence and emerging technologies increase silver use in data centers. With such a promising outlook, the upward trajectory of silver prices appears sustainable.

Investing in Silver: The Challenges and Opportunities

While the surge in silver prices is exciting, many investors are uncertain about how to take advantage of this opportunity. Physical silver is a common investment choice but comes with challenges like storage and insurance. Fortunately, there are more accessible and cost-efficient alternatives, such as silver stocks or Exchange-Traded Funds (ETFs).

One of the easiest and most efficient ways to invest in silver is through the iShares Silver Trust ETF (SLV). Analysts recommend this ETF due to its low cost and direct exposure to silver prices. The iShares Silver Trust tracks silver’s price by holding physical silver bullion, securely stored in bank vaults, allowing investors to benefit from silver’s price movement without owning the metal directly.

Why Choose the iShares Silver Trust ETF?

The iShares Silver Trust is the largest silver ETF globally, holding over 517 million ounces of silver and managing nearly $33 billion in assets as of December 2025. It provides direct exposure to silver price fluctuations without the need to own physical silver.

With a low expense ratio of 0.5%, it’s one of the most cost-efficient ways to invest in silver. In 2025, the ETF surged by over 110%, closely tracking silver’s price movements. As silver prices rise, the value of shares in the iShares Silver Trust increases accordingly.

This ETF offers several benefits to investors:

- No physical storage or insurance issues – Investors don’t need to worry about keeping silver in a vault.

- Liquidity – Investors can buy and sell shares of SLV on the stock market just like any other stock, making it a highly liquid asset.

- Diversification – By purchasing shares in SLV, investors gain exposure to silver prices without needing to purchase individual silver stocks, which can be more volatile.

Risks and Considerations

While the upside potential of silver is clear, investing in silver ETFs also involves certain risks. Silver prices can be volatile, particularly if global demand decreases or investor sentiment shifts. Additionally, as an ETF, SLV comes with management fees and other costs, though they are minimal compared to other silver investment forms.

Investors should manage risk and remember that while silver’s safe-haven status holds up in economic uncertainty, the market can still be unpredictable. Silver is also influenced by broader commodity market trends and global economic conditions, so it’s essential to stay informed.

Conclusion: The Silver Boom is Far from Over

The recent surge in silver prices offers a significant opportunity for investors, particularly in 2025, driven by industrial demand and clean energy trends. For those seeking to invest without physical ownership, the iShares Silver Trust ETF is an ideal choice, with its low-cost structure and direct exposure to silver prices.

Many analysts recommend this ETF for its strong performance, low expense ratio, and potential for further growth. As silver demand continues to rise and government policies push for a more secure supply, the future of silver looks promising, making it a smart investment option for both seasoned and new investors.