The semiconductor sector has quietly become one of the most powerful wealth creators of the past decade. Driven by explosive demand for computing power, artificial intelligence, cloud infrastructure, and advanced electronics, chipmakers have moved from a cyclical industry to a foundational pillar of the modern economy. One way investors have captured this growth is through sector-focused exchange-traded funds, including the Invesco Semiconductors ETF (PSI).

According to analysis shared by SkylineSFO, PSI offers a clear example of how targeted exposure to semiconductors has rewarded long-term investors, while also highlighting the risks that come with concentrated bets.

A Decade of Exceptional Returns

Over the last ten years, the Invesco Semiconductors ETF has delivered eye-catching performance. Since December 2015, the fund has generated a total return of approximately 820%, vastly outperforming the broader market. For comparison, the S&P 500 returned about 233% over the same period.

To put that into perspective:

- A $100 investment in PSI ten years ago would be worth around $920 today

- A $500 investment would have grown to roughly $4,600

- Larger long-term allocations would have compounded into even more substantial gains

This kind of growth underscores just how powerful the semiconductor cycle has been, and why investors continue to view chips as a long-term strategic investment.

What Is the Invesco Semiconductors ETF?

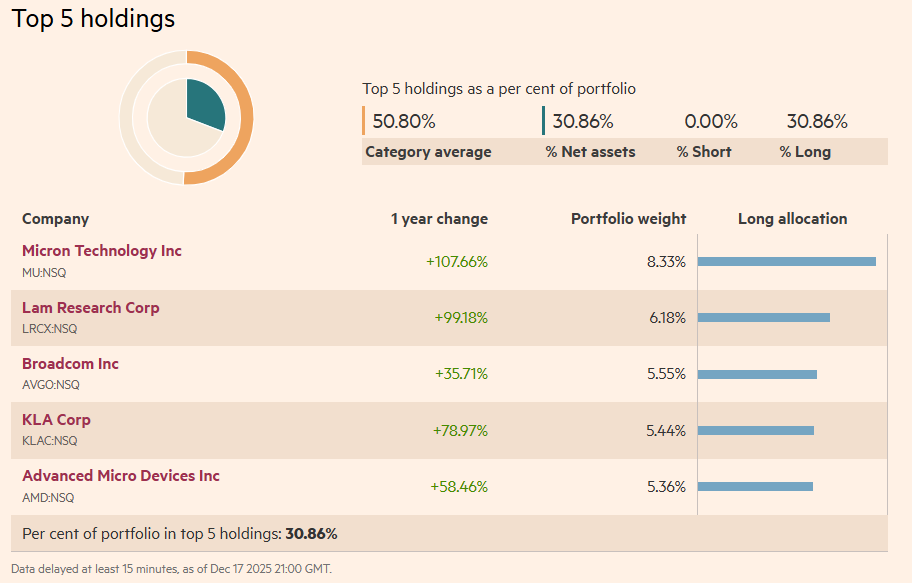

The Invesco Semiconductors ETF is a sector-specific fund holding 30 companies tied directly to the semiconductor industry. These include chip designers, manufacturers, and equipment providers that support the global chip supply chain.

By investing in PSI, investors gain exposure to:

- Leading chipmakers

- Semiconductor equipment companies

- Firms benefiting from AI, cloud computing, and advanced electronics

Rather than picking individual winners, PSI allows investors to participate in the sector’s overall growth while spreading risk across multiple companies.

Why Semiconductors Have Thrived

The strong performance of PSI reflects broader trends reshaping the global economy. Semiconductors are no longer just components for consumer electronics; they are essential infrastructure.

Key growth drivers include:

- Artificial intelligence and machine learning, which require massive computing power

- Data centers and cloud services, fueling demand for high-performance chips

- Electric vehicles, which rely on advanced semiconductors for power management and automation

- 5G networks and connected devices, increasing chip usage across industries

As AI adoption accelerates, semiconductor demand has moved into what many analysts see as a multi-year expansion cycle rather than a short-lived boom.

The Role of Diversification, and Its Limits

One of PSI’s advantages is diversification within a specialized niche. Holding 30 different semiconductor stocks helps reduce company-specific risk. If one chipmaker stumbles, others may continue to perform well.

However, it’s important to understand the limits of this diversification.

Because PSI is fully concentrated in one industry, it carries more risk than broad-market ETFs like those tracking the S&P 500. Semiconductor stocks can be volatile, particularly during economic slowdowns or periods of excess supply.

As SkylineSFO highlights, investors in narrow ETFs should ensure that the rest of their portfolio is diversified across sectors such as healthcare, consumer goods, financials, or energy to balance risk.

Volatility Is Part of the Journey

Higher returns often come with higher volatility, and PSI is no exception. Semiconductor stocks have historically experienced sharp drawdowns during downturns, even when long-term fundamentals remain intact.

That said, long-term investors who stayed invested through market cycles were rewarded. The past decade shows that patience and a long-term mindset were key factors behind PSI’s success.

For investors considering semiconductor exposure today, the lesson is clear: this is not a short-term trade, but a long-term growth allocation that requires discipline during periods of market stress.

Is PSI Still Worth Considering?

Looking ahead, the semiconductor industry continues to benefit from structural tailwinds. AI investment is expanding globally, governments are investing heavily in domestic chip production, and demand for computing power shows no signs of slowing.

However, valuation, competition, and cyclical risks remain important considerations. PSI may not repeat the same returns over the next decade, but the sector’s importance to the global economy suggests it could remain a strong contributor to long-term portfolios.

Final Takeaway

The Invesco Semiconductors ETF offers a compelling case study in how targeted sector investing can dramatically outperform the broader market over time. A modest $100 investment growing to nearly $920 illustrates the power of compounding when paired with the right long-term trend.

Semiconductor ETFs like PSI can play a valuable role in a diversified portfolio, especially for investors who understand the risks and are prepared to ride out volatility. For those with a long-term horizon and a balanced investment strategy, the semiconductor sector remains one of the most influential forces shaping future market returns.