AetheriumX announced today its participation in the “2026 Seoul Signal: Navigating the Next Wave of Web3.” The event will take place on January 22 at People the Terrace in Gangnam, Seoul. AetheriumX will detail its approach to building sustainable Web3 growth through its Distributed Capital Intelligence Protocol (DCIP).

The event focuses on three areas: market structure, capital flow, and execution strategy. AetheriumX intends to move the conversation away from short-term narratives and toward a system that integrates users, capital, and real-world use cases.

Moving Beyond Inflationary Incentives

The current market is shifting away from the high-APR race. Many platforms rely on inflationary incentives to boost Total Value Locked (TVL), but these methods often fail to retain users. GameFi projects without durable cash flow also face survival challenges across market cycles.

AetheriumX functions as a Distributed Capital Intelligence Protocol. It connects non-custodial on-chain assets with a programmable strategy execution layer. This allows capital to generate returns within a verifiable framework. The protocol turns yield formation into an interactive experience for the user.

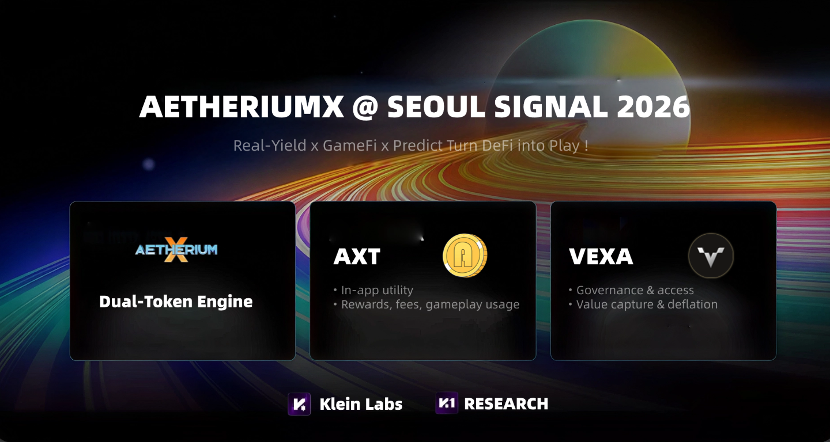

The AXT and VEXA Economic Model

The platform uses a dual-token structure to manage its economy:

- AXT: The utility token for liquidity, gaming, and platform fees.

- VEXA: A governance and value-accrual token that captures growth from real platform activity.

AetheriumX replaces unlimited token emissions with a structured buyback-and-burn mechanism. The system converts ecosystem volume into value for the VEXA token.

Specific mechanisms include:

- GameFi Allocation: A set percentage of each round’s pool and a portion of AXT from losing positions are used to buy back and burn VEXA.

- AXT Predict: Marginal revenue from the prediction market is directed to VEXA buybacks.

- Protocol Fees: A portion of returns and fees are automatically allocated to the deflationary loop.

Multi-Asset Staking and Strategy Mapping

AetheriumX uses mainstream assets like USDT, ETH, BNB, and SOL for staking. These are mapped to diversified strategy sources across DeFi, CeFi, and Real-World Assets (RWA). The protocol emphasizes transparent accounting to ensure all flows are traceable.

This setup functions as a long-term account system. Staking provides a baseline yield, while platform interaction creates incremental demand. Governance and rights tokens then crystallize that value over time.

Event Participation

At Seoul Signal, AetheriumX will join builders and creators to discuss how to build Web3 systems that do not self-dilute. The team will address why capital stays in an ecosystem and how to move from narratives to verifiable execution.

Event Details:

- Date: January 22, 2026

- Time: 18:30 – 23:30

- Location: People the Terrace, Gangnam, Seoul

- RSVP: https://luma.com/ufr49cpv

About AetheriumX

AetheriumX is a Distributed Capital Intelligence Protocol (DCIP) focused on sustainable on-chain growth. By combining strategy execution with real use cases and a buyback-and-burn economic model, AetheriumX provides a transparent and compounding yield environment for Web3 participants.

Media Contact:

Website: https://axt.fun

X (Twitter): https://x.com/aetheriumX_fun

Telegram: https://t.me/AetheriumX_fun