McDonald’s is one of the most recognizable brands in the global consumer landscape, and its stock often serves as a bellwether for trends in discretionary spending. In 2025, the fast-food giant delivered a solid but uneven performance, shaped by shifting consumer behavior, economic pressures, and a strategic return to its roots.

According to SkylineSFO, understanding what worked in 2025 and what still needs improvement is essential for investors evaluating McDonald’s prospects heading into 2026.

How McDonald’s Stock Performed in 2025

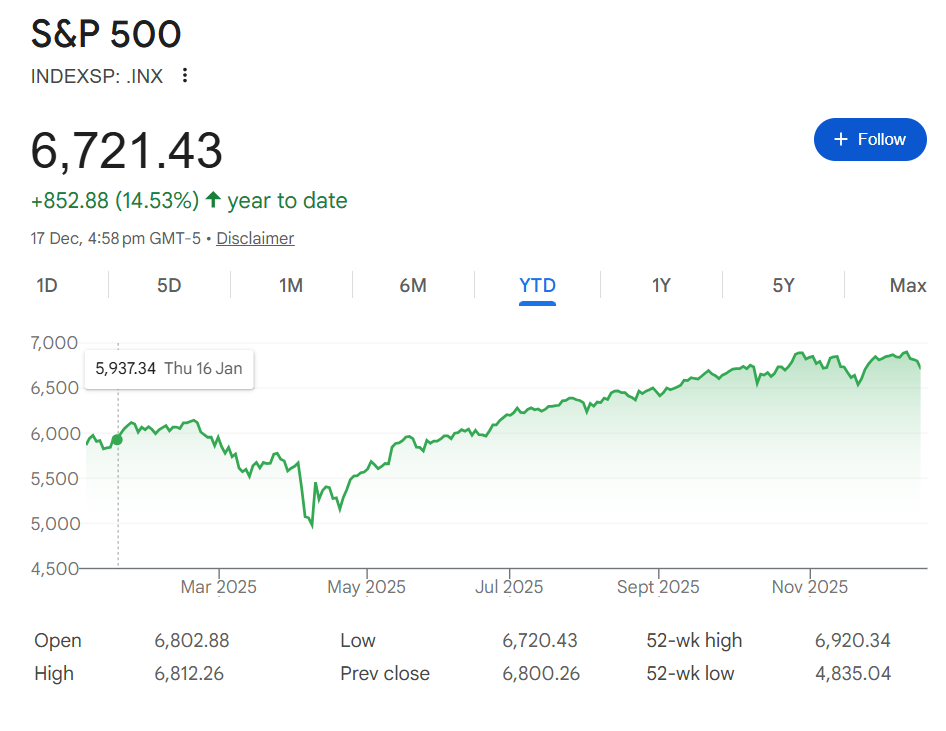

McDonald’s shares rose 9.3% in 2025, and when dividends are included, the total shareholder return reached 11.1%. While this represents healthy growth, it lagged the S&P 500, which climbed roughly 17.5% over the same period. The underperformance highlights that, while McDonald’s remains resilient, it did not fully participate in the broader market rally.

Despite this relative lag, 2025 marked a turning point operationally. The company spent much of the previous period grappling with sluggish same-store sales after drifting away from the value-driven pricing that historically attracted its core customer base. Higher menu prices and reduced emphasis on affordability caused traffic to soften, particularly among lower-income consumers.

Management responded by re-centering the menu around value, reintroducing lower-priced options, and promotional offers. These changes were not merely cosmetic; they represented a strategic shift back to McDonald’s core identity.

The early results were encouraging. McDonald’s reported 3.6% comparable sales growth, with positive comps in both the U.S. and international markets, signaling that customers were responding to the renewed value focus.

Why Value Pricing Matters So Much

McDonald’s business model depends heavily on high transaction volumes, not premium pricing. While the brand has succeeded in attracting higher-income customers in recent years, its foundation has always been built on affordability, convenience, and consistency.

The renewed emphasis on value pricing is especially important as inflation remains sticky and household budgets stay under pressure. For many consumers, McDonald’s competes not just with other restaurants, but with grocery spending and at-home meals. If the company can convincingly position itself as a low-cost dining option again, it stands to benefit even in a slowing economy.

Key Economic Risks Heading Into 2026

Looking ahead, one of the most important variables for McDonald’s in 2026 will be the broader economic environment. Unemployment has ticked higher, and inflation, while moderating, remains elevated in many regions. Any meaningful deterioration in labor markets could pressure discretionary spending, particularly among McDonald’s most price-sensitive customers.

International markets also warrant close attention. McDonald’s operates globally, and economic softness outside the U.S. could impact traffic, currency translation, and profitability. Investors should monitor macro indicators closely, as McDonald’s performance often mirrors consumer confidence trends.

Shifting Customer Demographics

Another critical issue is who is eating at McDonald’s. Recent data shows an increase in visits from higher-income consumers, while traffic from lower-income groups has declined. While attracting wealthier customers can support margins, losing core customers poses a long-term risk to volume.

Management’s challenge in 2026 will be determining whether its value-focused initiatives can re-engage lower-income diners without alienating higher-income customers. Striking that balance will be essential for sustainable growth.

Franchisee Alignment Is Crucial

A defining feature of McDonald’s business is its franchise model. Roughly 95% of McDonald’s approximately 44,600 locations are operated by franchisees, making cooperation between corporate leadership and operators vital.

In 2026, management plans to work more closely with franchisees to ensure pricing strategies are executed consistently. This includes evaluating how well locations adhere to value-focused initiatives and whether pricing remains competitive across regions.

Strong alignment could drive higher traffic and improved customer satisfaction. Weak alignment, on the other hand, could dilute the impact of corporate strategy.

What Investors Should Watch in 2026

For investors, comparable sales growth and traffic trends will be the most important indicators to monitor. Strong comps driven by higher customer visits would suggest that value pricing is working. Conversely, flat or declining traffic could signal that economic pressure or pricing strategy remains a challenge.

Margins will also matter. While value pricing can lift volume, it must be balanced carefully to avoid excessive pressure on profitability, especially as input and labor costs remain elevated.

The Bottom Line

McDonald’s enters 2026 in a stronger operational position than it was a year ago, but meaningful risks remain. The company has regained some momentum by returning to its value roots, yet macroeconomic uncertainty, shifting customer demographics, and franchise execution will shape the next phase of growth.

As many trading experts highlight, McDonald’s is not without challenges, but its brand strength, global scale, and adaptability give it the tools to navigate a complex environment. For long-term investors, 2026 will be less about explosive growth and more about execution, consistency, and resilience, the traits that have defined McDonald’s success for decades.