For investors hunting for overlooked opportunities, not every compelling betting stock is listed on U.S. sportsbooks or tied to American football. One lesser-known name quietly gaining momentum is Codere Online Luxembourg (CDRO) a small-cap digital betting company that has largely flown under the radar, yet has delivered strong performance this year.

Analysts at SkylineSFO point out that Codere’s biggest differentiator may also be its greatest strength: it doesn’t operate in the United States at all.

A Sports Betting Stock Few Investors Are Watching

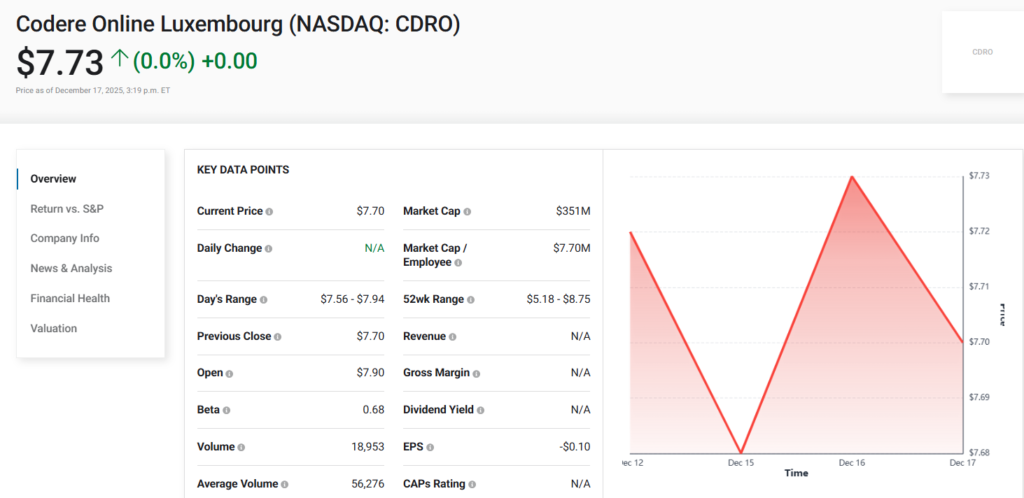

Codere Online currently carries a market capitalization of roughly $350 million, placing it firmly in small-cap territory. Unlike household names such as DraftKings or Flutter Entertainment, Codere does not generate headlines in North America, largely because it avoids the U.S. sports betting market entirely.

At first, staying out of the U.S. market may appear to be a disadvantage, especially given its reputation as the fastest-growing sports betting market globally. However, Codere’s performance tells a different story.

The stock is up nearly 20% year to date, outpacing several larger, U.S.-focused betting operators. This suggests that avoiding the intense competition and regulatory pressure in the U.S. has actually worked to Codere’s advantage, allowing the company to deliver stronger relative returns while operating in less crowded international markets.

The reason? Codere is insulated from several challenges currently weighing on U.S.-focused betting stocks.

Avoiding U.S. Headwinds Is a Strategic Advantage

In 2025, many American sportsbook operators have struggled with intensifying competition from prediction markets, along with growing regulatory uncertainty. Some U.S. states have warned licensed sportsbooks that involvement in event contracts or prediction-style markets could jeopardize their operating licenses.

Because Codere Online does not operate in the U.S., it avoids these risks altogether. The company is not exposed to evolving state-level regulations, nor does it face competitive pressure from U.S.-based prediction platforms that are disrupting traditional sportsbook economics.

This regulatory distance has helped Codere remain relatively stable while larger peers experience volatility tied to shifting legal and competitive dynamics.

A Strong Focus on High-Growth International Markets

Instead of the U.S., Codere Online concentrates on international internet casino and sports betting markets, with a particular emphasis on Spanish-speaking countries. Its most important regions include:

- Mexico

- Colombia

- Argentina

- Spain

The company also has exposure to Italy, South Africa, and the United Kingdom, but Latin America remains the core growth engine.

These regions are seeing rapid adoption of online wagering, driven by increasing smartphone penetration, younger demographics, and a cultural passion for sports, especially soccer. From a macro perspective, Codere’s geographic footprint positions it to benefit from structural growth trends that are still in relatively early stages.

A Hidden Play on Global Soccer Betting

One overlooked catalyst is the 2026 FIFA World Cup, which will attract massive global betting interest. While U.S.-centric sportsbook stocks may dominate headlines, Codere’s exposure to soccer-obsessed markets arguably makes it a more direct beneficiary of World Cup-related wagering activity.

Countries like Mexico, Argentina, Colombia, and Spain consistently rank among the most engaged soccer audiences worldwide. That gives Codere a unique angle compared to rivals whose revenues are more heavily tied to American sports such as football and basketball.

For investors looking beyond short-term hype, Codere offers a way to tap into global sports betting demand rather than U.S.-only trends.

Valuation and Takeover Potential

Another reason Codere is drawing attention is valuation. Compared with larger betting peers, the stock is often described as inexpensive relative to its growth outlook, especially considering its exposure to emerging markets where online betting adoption is accelerating.

As Latin America’s digital wagering market matures, Codere could become an attractive acquisition target. Larger global betting operators may find it more efficient to buy established regional platforms rather than build market share from scratch. Codere’s existing licenses, brand presence, and customer base could make it a strategic entry point for potential suitors.

The Bottom Line

Codere Online may not be widely recognized, but that lack of attention could work in investors’ favor. By avoiding the crowded and heavily regulated U.S. sports betting market, the company has focused on high-growth international regions, particularly Latin America and Spain, where competition is less intense and long-term demand is expanding.

Codere benefits from strong exposure to soccer-driven markets, potential 2026 World Cup betting momentum, and reduced regulatory risk compared with the U.S.-centric rivals. Trading below $10 per share, the stock offers investors a chance to gain exposure to fast-growing online wagering markets at a relatively modest valuation.