Bitcoin is once again diverging from traditional markets in a way that hasn’t happened in more than a decade, and investors are taking notice. According to market observers at SkylineSFO, this unusual setup could shape Bitcoin’s performance well beyond the short term, even as near-term risks remain elevated.

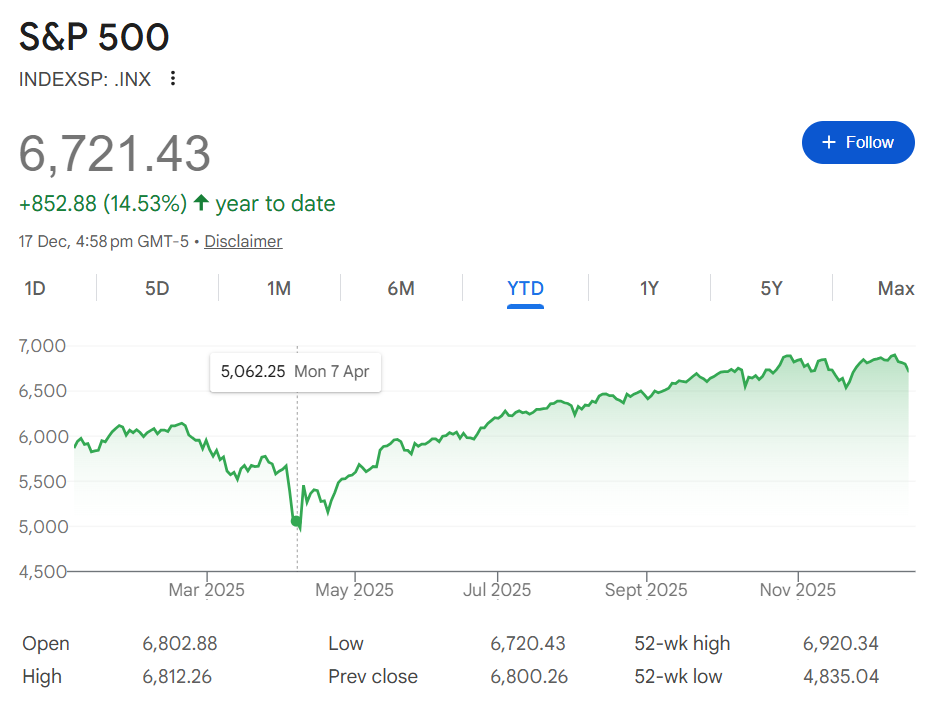

So far this year, the S&P 500 has climbed roughly 15%, while Bitcoin has slipped about 5%. If this gap holds through year-end, it would mark the first time since 2014 that U.S. equities finished higher while Bitcoin ended the year in negative territory. That historical parallel is notable because what followed in the years after 2014 offers both optimism and caution.

What Happened the Last Time This Occurred?

In 2014, Bitcoin significantly underperformed traditional markets. However, the following year told a very different story. While the S&P 500 largely moved sideways in 2015, Bitcoin surged roughly 38%, beginning a longer multi-year cycle that ultimately led to one of its most powerful bull runs.

This historical pattern is one reason some market participants believe Bitcoin could rebound strongly after a weak relative year. However, history also shows that these rebounds are rarely smooth or immediate.

The Bullish Case for Bitcoin Going Forward

The long-term investment thesis for Bitcoin continues to center on institutional adoption, corporate treasury usage, and regulatory normalization. One of the most significant developments over the past two years has been the rapid growth of spot Bitcoin exchange-traded funds (ETFs).

These products have dramatically lowered the barriers to entry for large investors by allowing Bitcoin exposure through traditional brokerage accounts. As a result, the number of major asset managers holding Bitcoin exposure has expanded sharply, and public companies have increased their Bitcoin holdings at a rapid pace.

Regulatory momentum has also improved. In the United States, recent legislative progress around digital asset oversight and stablecoin frameworks has helped reduce uncertainty. While not Bitcoin-specific, these developments signal that cryptocurrencies are becoming increasingly integrated into the financial system rather than existing on its fringe.

For long-term investors, this combination of simplified access, institutional legitimacy, and fixed supply continues to support the case for higher prices over time.

Why 2026 Could Be More Complicated Than It Looks

Despite the optimistic long-term narrative, Bitcoin’s historical price cycles suggest that 2026 may not be an easy year.

Bitcoin has consistently followed a pattern tied to its halving events, which occur roughly every four years. Prices have historically peaked 12 to 18 months after a halving, followed by a period of decline or stagnation before the next cycle begins.

The most recent halving occurred in April 2024, and Bitcoin reached a cycle high in late 2025. If past patterns repeat, Bitcoin could experience continued weakness into late 2026 or early 2027 before stabilizing and gradually recovering ahead of the next halving expected in 2028.

There is additional historical data that supports caution. Since 2021, Bitcoin has entered bear-market territory, defined as a 20% decline from recent highs, on multiple occasions. Following similar drawdowns in the past, Bitcoin’s average return over the next 12 months has been close to flat.

This does not imply that Bitcoin is “broken,” but it does suggest that investors expecting immediate gains may be disappointed.

Wall Street Optimism vs. Historical Reality

Some market forecasts still project Bitcoin reaching significantly higher levels in 2026, pointing to ETF inflows, institutional demand, and long-term scarcity. These targets imply substantial upside from current prices, even after factoring in a more challenging macroeconomic environment.

However, historical precedent urges caution. Bitcoin’s strongest returns have often come after extended periods of consolidation, not immediately following peaks. Investors who entered past cycles expecting quick recoveries often had to endure months, or even years, of volatility before being rewarded.

The Big Picture for Investors

Bitcoin’s current behavior, underperforming equities during a strong stock market year, is rare, but not unprecedented. History suggests that such periods can precede powerful rallies, yet they can also involve prolonged drawdowns along the way.

For investors with a long time horizon, Bitcoin’s core value proposition remains intact: a scarce digital asset with growing institutional acceptance. For shorter-term investors or those uncomfortable with volatility, 2026 could prove frustrating rather than rewarding.

As analysts emphasize, Bitcoin should only be considered by investors who are prepared to hold through full market cycles, not those seeking predictable annual returns. The next major upside may come, but history suggests patience will likely be required before it arrives.