Artificial intelligence stocks have dominated market headlines for much of the past two years, and few names have been as central to that story as Nvidia. After reaching record highs in October, however, the stock has cooled off, leaving investors wondering whether a late-year rebound is still possible.

Brokers from SkylineSFO are closely watching the situation, as Nvidia’s historical trading patterns, broader market conditions, and recent earnings all provide important clues about what could happen next.

A Pullback That Has Happened Before

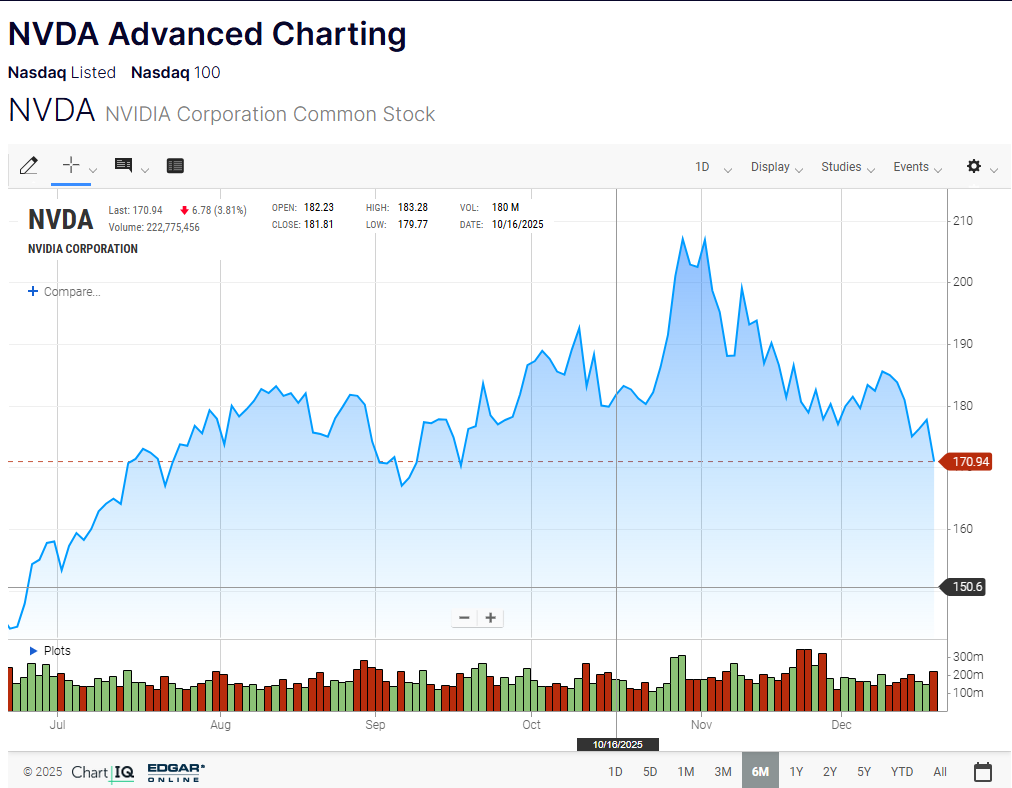

Nvidia shares are down roughly 17% from their October peak, a pullback that, while notable, is not unusual for the AI chip leader. Similar declines in the past have often been followed by strong recoveries, making timing the key factor.

Historically, December has been a volatile and active month for Nvidia, with several sharp late-year rallies. The stock gained 8.8% in December 2024, 10.1% in 2023, and 13% in 2022 over short periods. Most notably, Nvidia surged 33.9% in December 2016, showing that powerful year-end rebounds are possible, even after periods of weakness.

That said, context matters. Back in 2016, Nvidia’s market capitalization was under $64 billion. Today, it sits near $4.3 trillion, meaning that percentage gains now require hundreds of billions of dollars in added value. A return to October’s record closing price of $207.04 would require a roughly 17.4% increase, equivalent to about $700 billion in market capitalization. That is a much heavier lift.

NVIDIA Often Mirrors the Market, With Amplification

One consistent pattern stands out: Nvidia tends to amplify broader market trends. When the market rallies, Nvidia often rallies more. When the market struggles, Nvidia’s declines are usually steeper.

This pattern was evident in recent years. In December 2022, Nvidia dropped 22.3%, while the S&P 500 fell just 5.9%. Last year, Nvidia slid 11.2%, compared to a 3.5% decline in the broader market. NVIDIA’s volatility works both ways.

Unfortunately for bulls hoping for a year-end miracle, overall market momentum has slowed. The S&P 500 gained 24.5% earlier in the year, but growth decelerated to 7.8% in the third quarter and just 1.9% so far in the fourth quarter.

This slowdown occurred despite three Federal Reserve interest rate cuts, and no additional cuts are expected before year-end. Without a strong market-wide rally, Nvidia may struggle to deliver an outsized rebound in a short time frame.

Fundamentals Are Strong, But Already Known

From an operational standpoint, Nvidia continues to deliver standout performance. In its latest earnings report, the company posted record revenue of $57 billion, marking 62% year-over-year growth. Earnings per share climbed 67% to $1.30, while GAAP gross margins reached 73.4%, underscoring Nvidia’s strong pricing power and efficiency.

Demand remains exceptionally strong, with management stating that Blackwell chip sales are “off the charts” and cloud GPUs effectively sold out. Looking ahead, Nvidia forecasts $65 billion in fourth-quarter revenue and GAAP gross margins of 74.8%, signaling sustained momentum as the company moves into 2026.

The challenge for investors is that this news is already priced in. While the results are impressive, they may not be enough on their own to justify an immediate $700 billion increase in market value within the final trading days of the year.

What Could Move the Stock?

A meaningful year-end surge for Nvidia would likely depend on unexpected, company-specific catalysts, such as setbacks for competitors or a major shift in the AI chip landscape.

In the absence of such developments, there is no clear near-term trigger for a sharp rally. While competition from custom AI chips and high-end alternatives continues to evolve, no immediate disruption is evident, suggesting Nvidia’s stock is likely to remain range-bound through the holidays.

Looking Beyond the Calendar

While a new all-time high before year-end appears unlikely, Nvidia’s long-term outlook remains intact. The company continues to sit at the center of AI infrastructure spending, with demand from cloud providers, enterprises, and governments showing no signs of slowing.

Looking ahead, 2026 is shaping up to be another strong year as AI adoption accelerates across industries. For investors, the recent pullback may represent an opportunity rather than a red flag, offering a more attractive entry point for those with a long-term investment horizon.

Final Thoughts

A dramatic December comeback is possible, but the odds appear limited given broader market conditions and Nvidia’s already massive valuation. Still, Nvidia’s fundamentals remain exceptionally strong, and its role in the AI ecosystem is firmly intact. Many trading experts suggest that while patience may be required in the short term, Nvidia continues to look like a compelling long-term holding as the AI revolution marches forward into 2026.