The rapid rise of artificial intelligence has reshaped not only technology markets but also the global energy landscape. As data centers expand to support AI model training and deployment, electricity demand is climbing for the first time in years.

Brokers from SkylineSFO note that this surge has reignited interest in alternative energy sources, including nuclear power, which many on Wall Street now view as a potential long-term solution for powering AI-driven infrastructure.

Yet while nuclear energy stocks have captured investor attention, the question remains whether they are truly worth buying in 2026, or if enthusiasm has raced far ahead of fundamentals.

AI Is Driving a New Wave of Electricity Demand

Artificial intelligence has emerged as an unexpected catalyst for energy investment, driven largely by the rapid expansion of data centers. These facilities require enormous amounts of continuous electricity, and analysts estimate that over $1 trillion in power-related capital investments may be needed between now and 2029 to support rising demand. While renewable energy sources such as wind and solar remain essential, they face challenges due to intermittency and storage limitations.

In contrast, nuclear energy provides stable, round-the-clock power, making it well-suited for always-on infrastructure like AI-driven data centers. As a result, nuclear power is regaining attention, returning to the spotlight after decades of skepticism, as governments and investors seek reliable, scalable energy solutions for the AI era.

Why Nuclear Startups Are in Focus

Two companies often mentioned in the nuclear resurgence narrative are Oklo and NuScale Power. Both aim to develop small modular reactors (SMRs), which are designed to be cheaper, faster to deploy, and more flexible than traditional nuclear plants.

- Oklo is working on a compact reactor concept that would use recycled nuclear waste and generate power for targeted applications such as military installations or data centers.

- NuScale Power has received formal design approval from the Nuclear Regulatory Commission (NRC) for its SMR, capable of producing 77 megawatts per unit.

With estimates suggesting that the U.S. may need around 50 gigawatts (50,000 megawatts) of additional capacity by 2030, proponents argue there could be room for hundreds of SMRs nationwide.

Stock Prices Have Risen Faster Than Business Progress

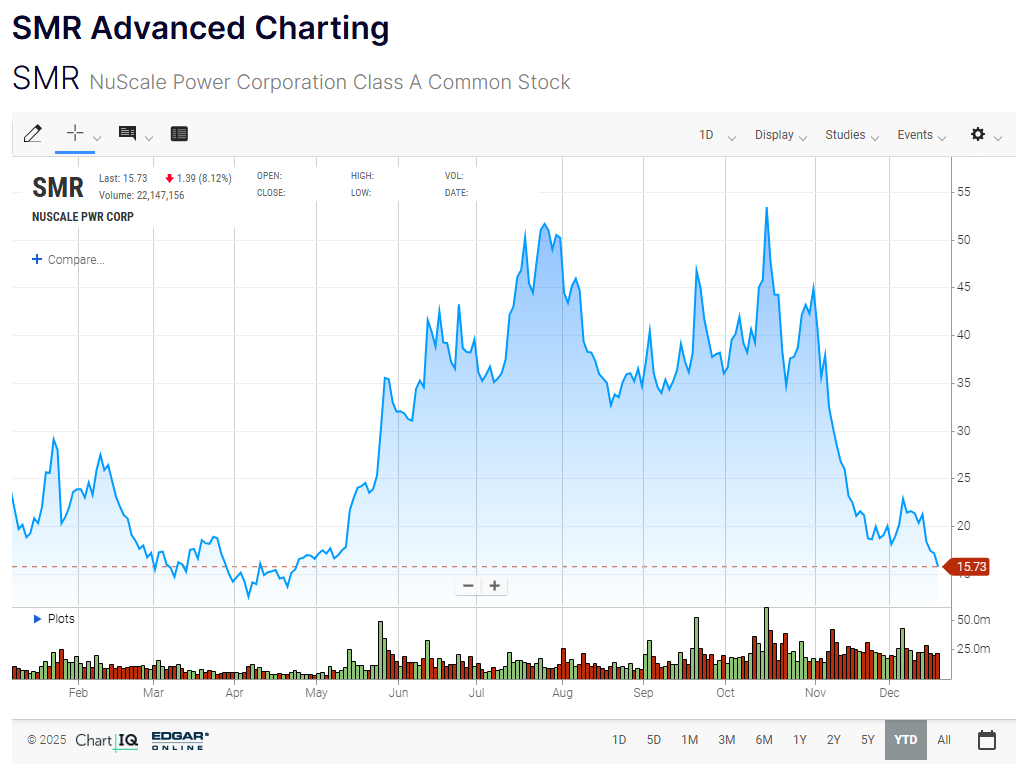

Investor optimism has already been reflected in stock prices. Over the past three years:

- Oklo shares surged roughly 733%

- NuScale Power gained about 65.6%

Market capitalizations now sit at approximately $12.9 billion for Oklo and $5.3 billion for NuScale Power.

However, these gains are not backed by mature operations. Neither company has built a functioning nuclear reactor. While NuScale has an approved design, its previous flagship project in Utah was canceled due to cost overruns. A recent agreement with the Tennessee Valley Authority remains early-stage, with no reactors constructed to date.

Oklo faces even steeper challenges. The company has generated no revenue and has yet to submit a final reactor design for regulatory approval.

Financial Reality Check

From a financial standpoint, both companies are burning cash at alarming rates:

- Oklo posted a negative free cash flow of about $68 million

- NuScale Power reported a negative free cash flow of roughly $283 million

NuScale generated $64 million in revenue, but most of it came from feasibility studies and development contracts rather than power generation. These figures highlight the gap between market enthusiasm and operational execution.

Importantly, as of mid-December 2025, both stocks are already down around 50% from recent highs in less than three months, signaling that speculative momentum may be fading.

Should Investors Buy Nuclear Energy Stocks in 2026?

At present, buying nuclear energy stocks like Oklo or NuScale Power is largely a bet on future industry transformation, not on current earnings or proven business models. While nuclear power may indeed play a role in meeting AI-driven electricity demand over the next decade, timelines remain uncertain, and regulatory hurdles are significant.

Without meaningful revenue, completed reactors, or clear paths to profitability, these companies remain highly speculative. Rising interest rates, funding constraints, or project delays could further pressure valuations.

Final Outlook

Nuclear energy may be undergoing a conceptual renaissance, but from an investment perspective, the sector still lacks the financial substance needed to justify today’s stock prices. Many experts caution that while the long-term narrative is compelling, 2026 may not be the right entry point for most investors.

Until nuclear startups demonstrate real-world execution, stable contracts, and improved cash flow, nuclear energy stocks are likely to remain volatile. For now, investors may be better served watching the sector from the sidelines rather than chasing a theme that has yet to deliver tangible results.