Key Points:

- Aristotle Capital Boston sold 123,119 shares of Itron (ITRI) in the third quarter, reducing its position by $18.35 million.

- As of September 30, the fund reported holding 303,560 ITRI shares valued at $37.8 million.

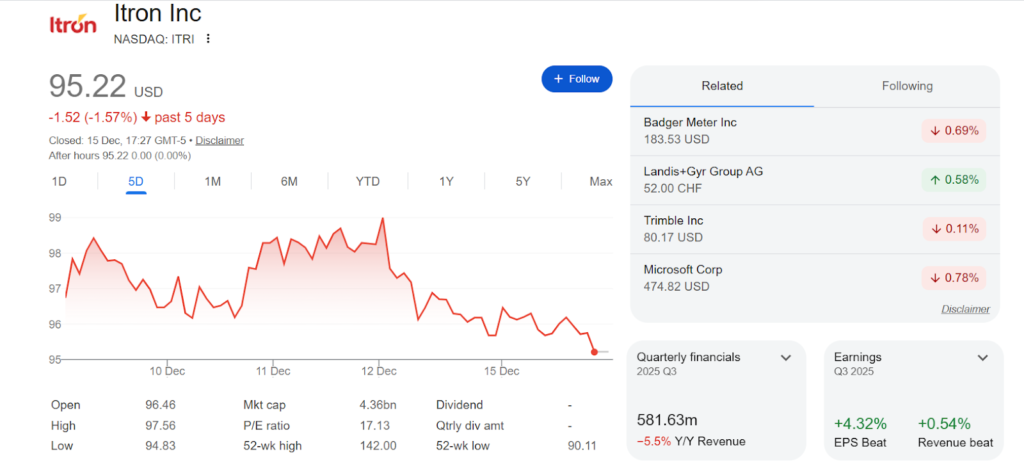

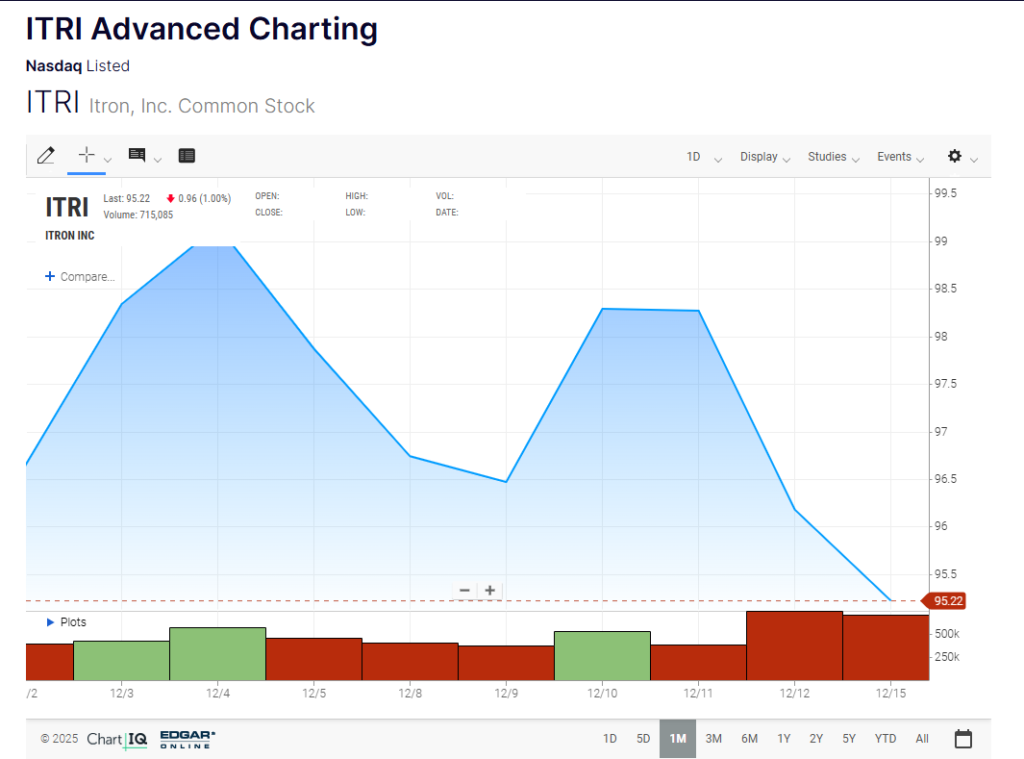

- Itron has faced a 15% decline in share price over the past year, underperforming the S&P 500, which is up 13% in the same period.

The recent move by Aristotle Capital Boston to reduce its stake in Itron raises important questions about the company’s future in a long-term portfolio. Despite Itron’s impressive innovations and strong operational fundamentals, its share price has been underperforming.

Brokers from SkylineSFO dive into whether long-term investors should follow suit or if Itron still presents a viable opportunity.

What Happened?

In a November 14 SEC filing, Aristotle Capital Boston revealed it sold 123,119 shares of Itron in the third quarter of 2025, contributing to a $18.35 million reduction in the value of its position. Following this transaction, the fund reported holding 303,560 ITRI shares worth $37.8 million as of September 30. This decrease came after a sharp rally in Itron’s stock, followed by a sudden reversal, raising questions about the stock’s short- and long-term outlook.

At the time of the filing, Itron represented 1.95% of the fund’s U.S. equity AUM. The fund’s largest holdings include Dycom, valued at $44 million, ACI Worldwide at $44.6 million, and Huron Consulting at $54 million.

These stocks have all shown strong recent performance, contributing to the fund’s overall positive results. The consistent growth of these major holdings reflects the fund’s strategic positioning and ongoing confidence in its top assets, reinforcing its position in the market.

Itron’s Performance and Market Trends

Itron’s stock has faced challenges over the past year, with its share price down 15%, significantly underperforming the S&P 500, which has risen 13%. However, in the last quarter, Itron’s shares surged before pulling back by about 20%, likely prompting the fund to lock in some gains through this sale rather than signalling a lack of confidence in the business.

Itron is a leading provider of technology solutions for energy, water, and smart city management, with products that include smart meters, sensors, and data analytics platforms. While revenue declined by 5% year over year to $582 million, largely due to project timing and portfolio optimisation, the company posted notable improvements in margins.

Gross margins expanded by 360 basis points to 37.7%, and adjusted EBITDA grew by 10% to $97 million. More impressively, free cash flow nearly doubled to $113 million, highlighting Itron’s ability to convert earnings into liquidity despite some revenue pressure.

Operational Strength and Backlog

Despite the near-term revenue challenges, Itron’s backlog stood at $4.3 billion, driven by strong demand for grid modernisation and smart infrastructure. Additionally, the company is seeing growth in its Outcomes segment, particularly in its recurring revenue streams. Itron remains well-positioned for long-duration utility spending, which is expected to increase as the world moves toward more sustainable and intelligent energy grids.

Aristotle Capital Boston’s decision to reduce its position likely reflects a tactical move to lock in profits rather than a loss of confidence in the company’s fundamentals. Itron’s recent pullback may represent consolidation after a strong rally, rather than a fundamental breakdown in its business model.

The growing demand for utility modernisation, smart infrastructure, and long-term utility investments points to a positive long-term outlook for Itron, especially for patient investors who can weather the market’s volatility.

The Bottom Line: Should You Follow Suit?

For long-term investors, Itron still presents a compelling investment opportunity. Despite the short-term price volatility, the company’s strong operational fundamentals, impressive cash flow, and backlog position it for future growth. The pullback in Itron’s stock is likely more of a market correction than a reflection of its true value.

Many financial analysts suggest that those considering Itron for their portfolios should focus on its long-term growth potential in the utility and smart infrastructure sectors, especially with the rising demand for renewable energy and technological advancements in the sector. For investors with a long horizon, this recent dip in Itron’s stock price may represent a buying opportunity.

However, as with any investment, it’s crucial to stay informed about broader market conditions, Itron’s evolving business strategies, and its competitive landscape in the utility tech space. For those willing to hold through short-term volatility, Itron could still be a strong player in the clean energy and utility sectors, offering substantial upside in the years ahead.